Basic accounting principles in Dynamics 365

Microsoft Dynamics 365 Finance is a comprehensive business management solution for mid-sized and larger organizations that works like and with familiar Microsoft software to help your people improve productivity.

Microsoft Dynamics 365 Finance and Operations apps are built to make it easy to do business across locations and countries by consolidating and standardizing processes, providing visibility across your organization, and help in simplifying compliance.

With Microsoft Dynamics 365 Finance and Operations apps, you can be confident your business management solution is and will continue to be, relevant to the needs of your people and the demands of your industry and business.

Expand easily across international borders with the country- and region-specific functionality, including capabilities for multiple languages and currencies and compliance with local financial requirements for over 36 countries/regions with the full support of GDRP and localization and regulatory features.

Consolidate financial, operational, and customer data while preserving local information to build your strategic edge and personalized customer, partner, and supplier relationships.

The first, and most important, the function of financial module in Microsoft Dynamics 365 Finance and Operations apps is to provide you with information that will help you see the trends taking place within your business's operation.

Throughout this article alongside our training videos, you will understand complete business processes by using a simple set of records, which makes it possible to show you what is happening with your business, which areas are productive and cost-effective, and will require the implementation of changes.

Configuration of Microsoft Dynamics 365 Finance must be tailored to your company needs. Obviously, a service-oriented industry will not use the same records as a retail business.

Quick Basics of General Accounting

Let's get familiar with the basics of general accounting. It is necessary to understand how terminology and practices of general accounting fit into Microsoft Dynamics 365 Finance and Operations apps, whether or not you are a professional in the accounting department in your company, a consultant work in a VAR (Value Added Reseller), a developer who wants to customize or modify functionality.

Income and Expenses

Every transaction that takes place involves money that is earned, spent, infused into, or taken out of business. All earnings and monies spent as a result of doing business fall under one of two classifications: income (or revenue) and expenses. Before you set up Financial Module in Microsoft Dynamics 365 Finance and Operations apps, let’s understand some basic facts about the two terms.

Income (Or Revenue)

Income is all the money received by your business in any given period of time. It is made up of monies derived from retail sales, wholesale sales, sale of service, interest income, and any miscellaneous income.

Expenses

Expenses are all the monies paid out by your business. They include those paid by check and those paid by cash. All require careful recording. Expenses fall into four distinct categories:

1) Cost of good sold (Inventory)

- The cost of the merchandise or inventory sold during an accounting period.

- Includes material and labor or the purchase price of manufactured goods.

2) Variable (selling) expenses

- Those expenses are directly related to the selling of your product or service.

- Include marketing costs, production salaries, vehicle expenses, machinery and equipment, and any other product or service overhead.

3) Fixed (administrative) expenses

- These are costs not directly related to your production or rendering of services. They are the type of expenses that all businesses have in common.

- Include normal office overhead such as accounting and legal, bank charges, office salaries, payroll expenses, rents, licenses, office equipment, telephone, utilities, etc.

4) Other expenses

- Interest expense

- Include monies paid out for interest on purchases, loans, etc.

Note: Some categories of expenses may be divided into both selling and administrative expenses. Examples are:

- Utilities. Those used for production as differentiated from utilities consumed in the office, heating, restrooms, etc.

- Telephone. Telemarketing and advertising are selling expenses. Monthly charges and office telephone charges are administrative expenses.

- Freight and postage. Shipping of your product is a selling expense. Postage used as office overhead is an administrative expense.

Deductible Expenses

Deductible expenses are those expenses that are allowed by the government when you are computing the net profit (loss) or taxable income at the end of your business tax year. To pay the least amount of income tax and maximize your own profits, you need to become familiar with those expenses that you are allowed by law to deduct. Knowing ahead of time which expenses are deductible will help you to better utilize them to your advantage while keeping proper records for income tax verification and business analysis.

Fully Deductible or Depreciable

Expenses fall into two major categories:

1) Fully deductible expenses: all expenses incurred in the operation of your business are deductible in their entirety in the year in which they occur and reduce your net income by their amount unless they are major expenses that fall in the depreciable assets category. Expenses will have to be itemized for tax purposes and receipts should be easily retrieved for verification.

2) Depreciable expenses: if you buy a business property with an expected life of over one year and is not intended for resale, it is considered a depreciable property. They generally include tangible assets as buildings, vehicles, types of machinery, and equipment and also intangible assets such as copyrights or franchises. Depreciation is taken at a fixed rate. The portion allowed for the current year is deducted as an expense.

Cash Accounting versus Accrual Accounting

Selecting the method to be used by your company is an important decision that must be made very early in the life of your business. Once it has been established, it is difficult to change due to government legalities.

The two methods are cash accounting and accrual accounting. Cash accounting is the most popular method used for small businesses because it is the most simple and direct to deal with. However, the government requires that certain types of businesses use the accrual basis of accounting.

Please note that Microsoft Dynamics 365 Finance and Operations apps are designed to support all types of businesses of any sizes, therefore it does support both Cash and Accrual methods.

1) Cash Accounting. The reporting of your revenues and expenses at the time they are actually received or paid. A company that uses the cash accounting method is considered to have made a transaction when the cash is physically received or paid out for services or products.

Pros:

- Simple

- Allows for use of single-entry accounting

- Taxes paid only on cash actually received

Cons:

- Does not closely match revenues and expenses to the actual period in which the transaction occurred

2) Accrual Accounting. The recognition of revenues and expenses at the time they are earned or incurred, regardless of when the cash for the transaction is received or paid out.

Pros:

- Provides a better analytical tool because it closely matches revenues and expenses to the actual period in which the transactions occurred.

Cons:

- Requires a more complex double entry system of accounting

- Income tax is paid on revenues invoiced out but yet received.

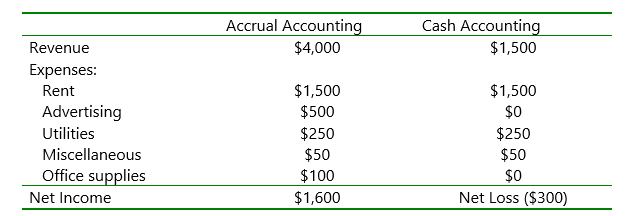

The following example helps you understand the difference between cash and accrual accounting:

Sabrina owns a consulting company. In January she earned $4,000 but received only $1,500 in check. At the same time, here expenses were:

- Rent: $1,500, which she paid

- Advertising: $500, which she did not pay

- Utilities: $250, which she paid

- Miscellaneous: $50, which she paid

- Office supplies: $100, which she did not pay.

Microsoft Dynamics 365 Finance and Operations apps are designed to simplify the accounting whether you use cash or accrual accounting. It performs lots of ledger posting using offset accounts. This simplifies the complex double-entry system.

Essential General Records

In the past, only double-entry accounting was thought to be proper for businesses. However, it is now generally recognized that a single-entry system will adequately serve much smaller (micro) businesses. As the business grows and becomes more complex, it will become necessary to move into double-entry accounting (best accomplished through the use of Microsoft Dynamics 365 Finance and Operations apps) in which each transaction is posted as a debit to one account and a credit to another.

Single Entry

This is a term referring to a manual bookkeeping system that uses only income and expense accounts. Your personal checkbook is an excellent example of single-entry record keeping. You can view the transactions via check register.

Double Entry

This is an accounting method by which every transaction is recorded as debits or credits. This is based on the premise that every transaction has two sides. A sale, for example, could be both delivery of goods and a receipt of payment. On your Balance Sheet, the delivery of goods to your customer decreases your inventory and would be recorded as a credit (reduction of assets), while the payment to you for the goods purchased from you would increase cash and would be recorded as a debit (an increase of assets). You should note that the words debit and credit do not have the usual non-accounting connotation in this application.

The two halves of the double-entry always have to be equal. Through the utilization of Microsoft Dynamics 365 Finance and Operations apps, the process has been simplified for the user, because the transaction is easily entered and matched to its primary account. Microsoft Dynamics 365 Finance and Operations apps then automatically debit or credit the proper corresponding account with the use of an offset account in a journal entry.

Note: in double-entry systems such as Microsoft Dynamics 365 Finance and Operations apps, at least two accounts must be used. The Balance Sheet equation must remain in balance after every transaction.

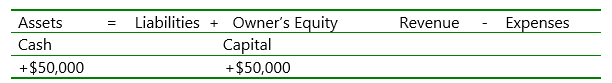

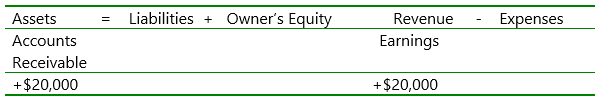

Example:

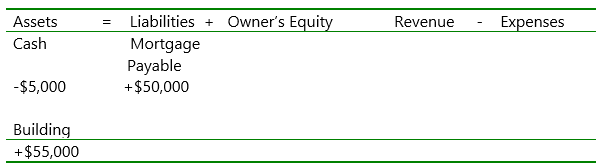

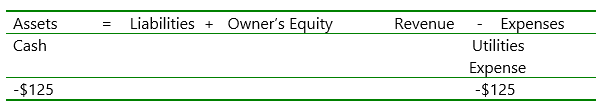

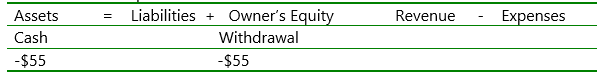

1. The company started with an investment of $50,000.

2. The company earned $20,000 on the account.

3. The company purchased a $55,000 building with $5,000 down and a mortgage for the remainder.

4. Paid $125 for the utility bill.

5. Paid personal (withdrawal from owner’s capital resources) telephone bill for $55

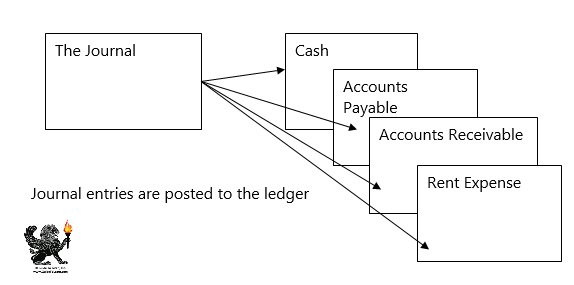

The flow of Accounting Data

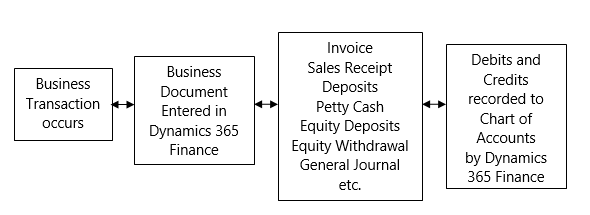

After a transaction is completed, the initial record of that transaction, or a group of similar transactions, is evidenced by a business document such as a sales ticket, a check stub, or a cash register tape. The amount of the debits and credits are automatically transferred to the proper accounts within the chart of accounts table in Microsoft Dynamics 365 Finance and Operations apps.

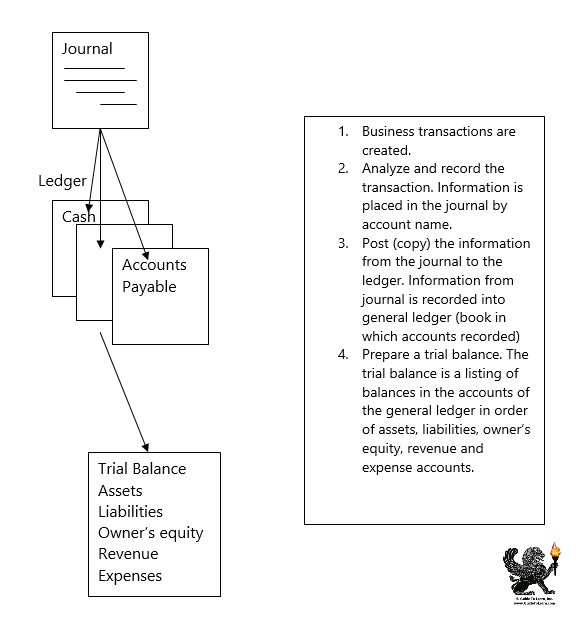

The flow of data from transaction to individual accounts may be diagrammed as follows:

Chart of Accounts

Double-entry software accounting such as Microsoft Dynamics 365 Finance and Operations apps requires that you set up a chart of accounts. These accounts are used when recording transactions in Microsoft Dynamics 365 Finance and Operations apps so that they will be properly posted to the correct accounts. Your chart of accounts must match your business.

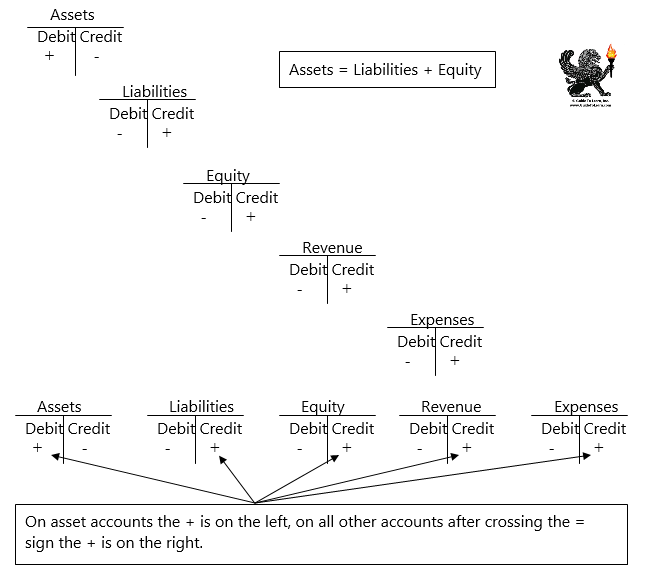

Debits and Credits

For every entry you make in Microsoft Dynamics 365 Finance and Operations apps journals, one account will be debited and the other will be credited. And the debits must equal the credits. Microsoft Dynamics 365 Finance and Operations apps automatically take care of both sides of this entry.

There is a well-known accounting equation that must always remain true in your business bookkeeping. The equation is as follow:

Assets – Liabilities = Net worth (equity/capital)

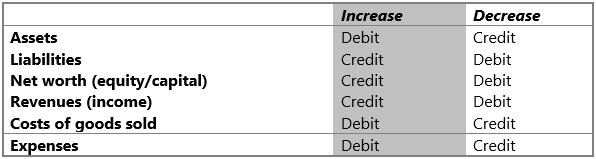

The accounting equation is kept in balance through the double-entry system such as Microsoft Dynamics 365 Finance and Operations apps. In the sample below you will see an example of a chart of accounts I have set up six different categories. Increases and decreases in each of these accounts are represented by debits or credits as follows:

Example1: When you buy office supplies with a check, you must credit (decrease) your bank account (an asset) and you will debit (increase) your office expense account (expense). One is debited and the other is credited in an equal amount.

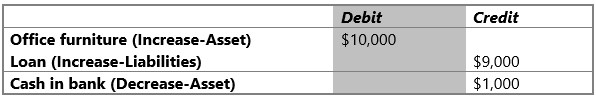

Example2: When you purchase $10,000 of office furniture and equipment, you make a down payment of $1,000, and take a loan for the $9,000 balance. The correct double entry for this transaction would be:

The debits and the credits balance ($10,000), but the increases and the decreases do not have to balance.

Note: To simplify the concept remember a simple rule; the one giving in the transaction is the creditor which records the corresponding account as a credit, and the one receiving in the transaction is the debtor which records the corresponding account as a debit. For example, if you sell one hour of your service, service revenue is the giver, therefore, is credited and cash in the bank is the receiver therefore cash is debited and increased.

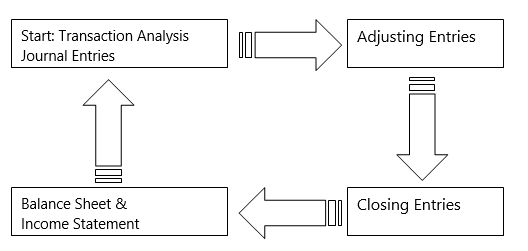

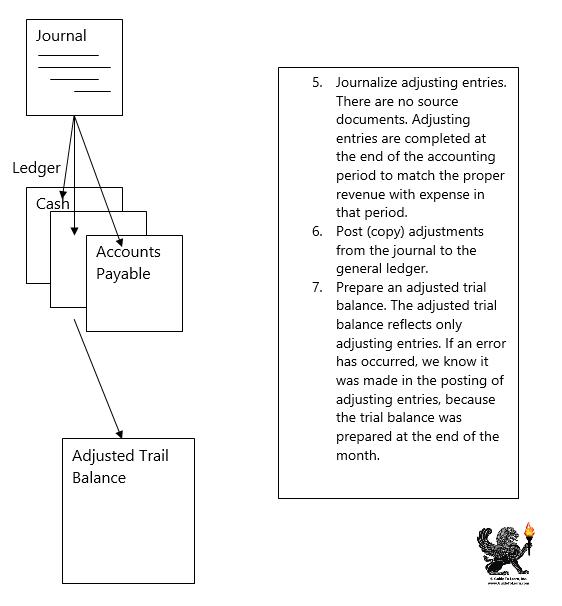

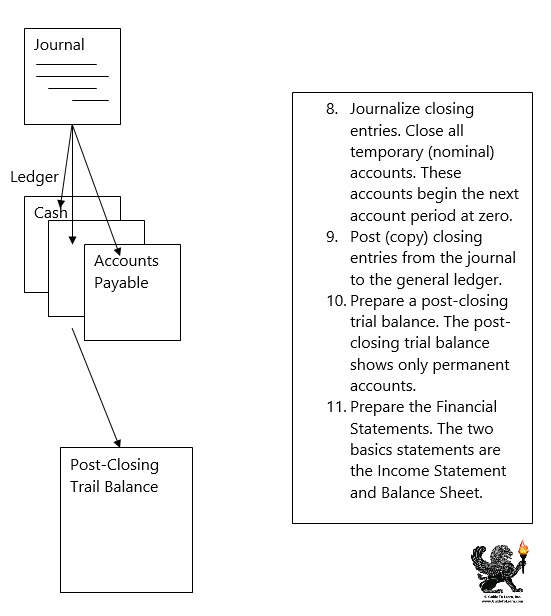

The Accounting Cycle

The entire accounting cycle of a business is shown below. Business transactions are recorded in a journal, during the month. At the end of the month, adjusting entries are prepared and placed in the journal. A final set of closing entries are then placed in the journal, and the financial statements such as the Balance Sheet and Income Statement are prepared.

- Journal: The book of original entry. All transactions are recorded here first.

- Transaction: Business papers and source documents.

- Adjusting Entries: these are entries to assign revenue and expenses in the period incurred. These additional month-end entries match expired costs and unrecorded revenues to the period.

- Balance Sheet: A snapshot of the business asset, liabilities, and owner’s equity (also known as net worth). Owner’s equity is the difference between the assets and liabilities.

- Income Statement: The profit and loss of a business based on earnings less expense. This statement reflects a period of time (usually one month).

- Closing Entries: Entries made to zero balance all temporary accounts at the end of the accounting periods.

Note: Permanent accounts are accounts that are not closed at the end of the period. There are Balance Sheet accounts (except for withdrawals). They carry current balances as long as the business continues.

Temporary accounts will be closed out to zero at the end of the period allowing the account to start the next period without previously accumulated funds.

The Ledger

Each business transaction is recorded in the journal and then posted (placed) into the ledger book.

The ledger has all the accounts listed in order, beginning with assets, liabilities, equity, revenue, and expense accounts.

The general method of recording these ledger account transactions in Microsoft Dynamics 365 Finance and Operations apps is done via Journal entries in most modules. This process consists of the following steps:

1) After reading the transaction, determine which of the accounts are affected. In Microsoft Dynamics 365 Finance and Operations apps, at least two accounts must be affected. The concept of an offset account is used to identify the second account.

2) Determine whether the accounts you selected are assets, liabilities, etc. This can be determined by choosing the Account Type column in a journal entry.

3) Determine if the accounts are increased (debited) or decreased (credited) by the transaction.

4) Place the correct amount on the proper side of the “T” account. This process can be achieved by choosing either the debit or credit column in a journal entry.

Note: “T” Accounting has been used for hundreds of years.

The increase and decrease of an account are difficult to understand. As a reminder please consider the following table: